A Path To Equity

Gina sees the responsibility of homeownership as something of a family tradition. She grew up in a home that her parents owned. From an early age she began to realize the value of having a place they could always come home to. Now, Gina intends to pass that tradition along to her two children.

“I want to show them that it can be done,” says Gina. “Show them the responsibility of ownership.”

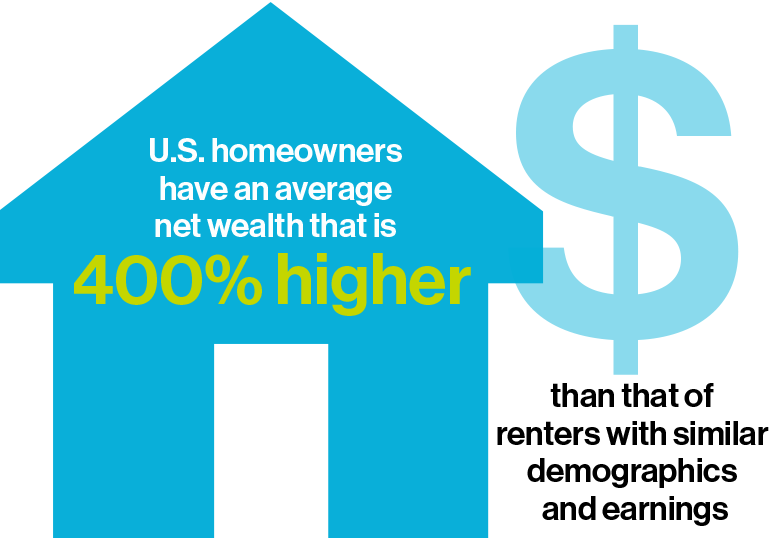

The investment in homeownership is one that often creates opportunities for generational wealth creation. U.S. homeowners have an average net wealth that is 400% higher than that of renters with similar demographics and earnings. In fact, home equity represents the largest proportion of wealth (34.5%) for U.S. households.

“It’s about having something to leave my kids,” says Gina. “To be able to say ‘This is what I did for us.’”

While the long term benefits are clear, most of Milwaukee Habitat’s homeowners begin seeing the financial benefits right away. The majority of Milwaukee Habitat homeowners spend less on their mortgage than they had on rent.

As the cost of housing has continued to rise, wages have not kept pace, creating significant barriers to homeownership. When families are spending half or more of their income on rent, as one in three Milwaukee renters are, it can make it extremely difficult to save for a down payment after all the other bills are paid. That’s where Habitat comes in. Together with supporters in our community, we break down the barriers to help families like Gina become first-time home buyers.

Gina’s 9 year old son, Josh, plays cello in the Milwaukee Youth Symphony Orchestra. Since finding out they’d been accepted into Habitat’s affordable homeownership program, Gina has been taking him to their future home after practice. He’s begun taking pictures of the construction progress every time they go. He and his older sister, Caylen, are so excited to have a home of their own. Gina’s using that excitement to instill the value of homeownership for generations to come.

MAKE A DIFFERENCE TODAY

WHAT DO WE ACCEPT?

START MAKING A DIFFERENCE