Habitat provides you with the coaching, education and support to be successful in your home buying journey. We can help you buy a home you love with a mortgage you can afford. First-time homebuyers can build a brand new home with little-to-no down payment and an average mortgage payment of less than $950/month.

Interested? This Is Your First Step

Complete this quick assessment to see if you meet some of our basic program requirements.

Basic Qualifications

- Be a first-time homebuyer

- Have an income of at least $35,000 per year ($2,917/month) - See chart below for income requirements based on family size

- Have no outstanding judgements (closed cases must be paid in full) or liens - Not sure? Check your records here

- Have availability to complete 210 hours of sweat equity helping on construction sites or in our ReStores

- See answers to Frequently Asked Questions

Interested? This Is Your First Step

Complete this quick assessment to see if you meet some of our basic program requirements.

Benefits of Habitat Homeownership

- Typical mortgage payment: less than $950/month

- Own your home

- Built brand new

- Energy efficient

- New appliances

- 3-4 bedrooms

- Minimal down payment

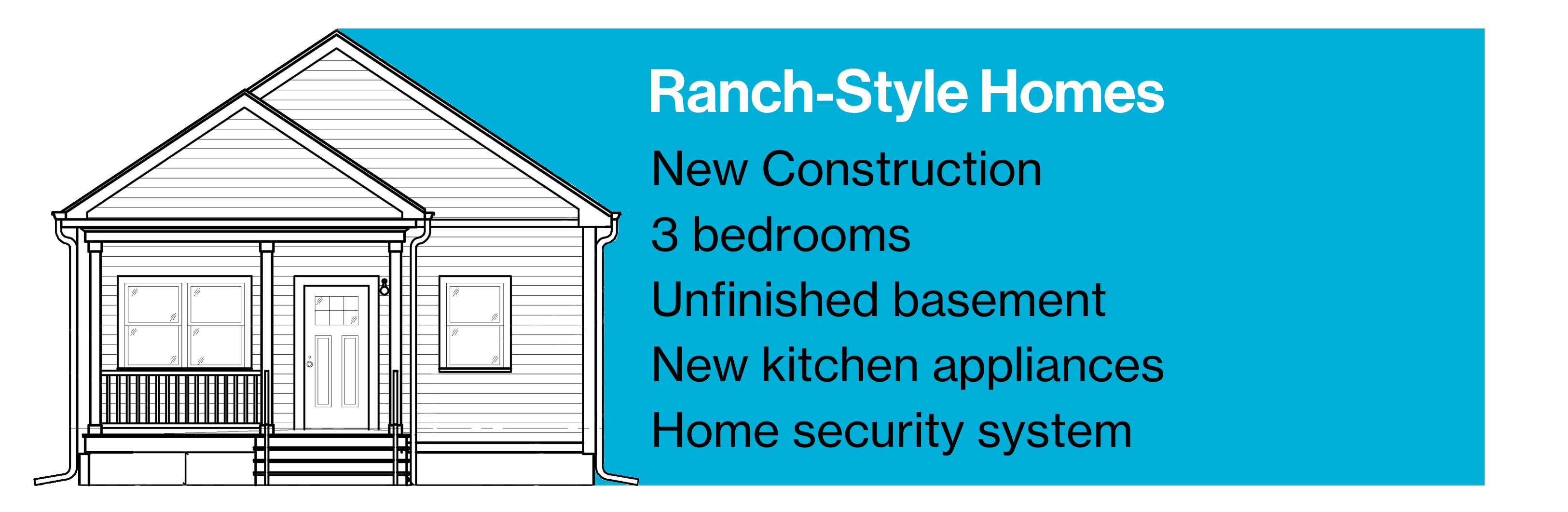

Home Tour

Milwaukee Habitat's brand new ranch style model is 3 bedrooms, 1 bath, and an open concept dining and living room. All homes come complete with brand new Whirlpool appliances, a home security system, and energy efficient windows. Depending on the season when you’re approved, homeowners may be able make design specifications such as selecting siding color, counter-tops and style of flooring.

Interested? This Is Your First Step

Complete this quick assessment to see if you meet some of our basic program requirements.

Location

In 2023, Milwaukee Habitat launched an ambitious plan to double the number of homes we build and repair by 2028. In doing so, we've expanded our new home construction to multiple north side neighborhoods. In 2024 alone, Milwaukee Habitat is building 32 brand new homes in neighborhoods like King Park, Harambee, and Midtown. Whenever possible, we work to cluster these new homes - building multiple homes on a single block. These maps show the new homes we've been building in 2023 and 2024.

Household Income Guidelines

| Family Size | Minimum Yearly Gross Income | Maximum Yearly Gross Income |

|---|---|---|

| 1 | $35,000 ($2917/month) | $57,200 ($4766/month) |

| 2 | $35,000 ($2917/month) | $65,400 ($5450/month) |

| 3 | $35,000 ($2917/month) | $73,550 ($6129/month) |

| 4 | $35,000 ($2917/month) | $81,700 ($6808/month) |

| 5 | $35,000 ($2917/month) | $88,250 ($7354/month) |

| 6 | $40,000 ($3333/month) | $94,800 ($7900/month) |

| 7 | $40,000 ($3333/month) | $101,350 ($8445/month) |

| 8 | $45,000 ($3750/month) | $107,850 ($8987/month) |

| 9 | $45,000 ($3750/month) | $114,400 ($9533/month) |

| 10 | $45,000 ($3750/month) | $120,950 ($10,079/month) |

Interested? This Is Your First Step

Complete this quick assessment to see if you meet some of our basic program requirements.

If you have questions please contact our Family Services department: fsapps@milwaukeehabitat.org

We are pledged to the letter and spirit of the U.S. policy for the achievement of equal housing opportunity throughout the nation. We encourage and support an affirmative advertising and marketing program in which there are no barriers to obtaining housing because of race, color, religion, sex, handicap, familial status, or national origin.